A Beginner's Tutorial to Buying and selling Abroad Futures: Unlocking Worldwide Options

A Beginner's Tutorial to Buying and selling Abroad Futures: Unlocking Worldwide Options

Blog Article

Trading overseas futures gives investors the chance to get involved in worldwide markets, diversify their portfolios, and tap into options outside of their house country. No matter whether you’re aiming to hedge towards hazards or speculate on price tag movements, investing futures on international exchanges is often a successful strategy. This information will investigate what abroad futures are, how they perform, and what you have to know to get going.

What exactly are Abroad Futures?

Abroad futures are standardized contracts traded on Global exchanges, where by the buyer agrees to buy, and the seller agrees to deliver, a certain asset in a predetermined selling price on the upcoming day. These assets can range between commodities like oil and gold to financial devices for example international indices or bonds. By buying and selling futures on worldwide exchanges, buyers can access a big range of markets and gain exposure to international economic traits.1722493534.gif)

How Does Overseas Futures Buying and selling Function?

Picking out a global Trade: Step one in trading overseas futures is to pick the suitable exchange. Popular Global futures exchanges incorporate the Tokyo Commodity Exchange (TOCOM), Eurex in Europe, along with the Singapore Exchange (SGX). Each Trade offers various futures contracts, so your preference will depend on the markets you’re keen on.

Opening a Futures Trading Account: To trade abroad futures, you’ll need to open up a futures investing account that has a broker that provides use of Global markets. Ensure that the broker is highly regarded and provides the mandatory tools, investigation, and assist for buying and selling on world wide exchanges.

Knowledge Margin Prerequisites: Much like domestic futures buying and selling, abroad futures usually demand you to deposit a margin—a portion of the whole contract value—as collateral. Margin necessities vary dependant upon the Trade, the asset staying traded, as well as deal measurement.

Forex Criteria: When buying and selling futures on international exchanges, currency fluctuations can affect your returns. You’ll ought to consider the Trade charge in between your private home currency and the currency of the exchange. Some traders use currency hedging techniques to mitigate this danger.

Marketplace Hours and Time Zones: Considering the fact that overseas futures are traded on exchanges in different time zones, it’s vital that you pay attention to the market hours. This might demand you to regulate your investing routine to align With all the opening several hours of Worldwide marketplaces.

Settlement and Shipping: Futures contracts can be settled both as a result of Bodily shipping and delivery on the asset or by way of dollars settlement. Most retail traders go for income settlement, the place the distinction between the contract value and the marketplace rate at expiration is paid out. Make certain to understand the settlement phrases with the contracts you’re buying and selling.

Benefits of Trading Abroad Futures

International Diversification: Buying and selling abroad futures enables you to diversify your portfolio by getting publicity to different economies, commodities, and fiscal devices worldwide.

Usage of Emerging Marketplaces: International futures exchanges give use of rising markets, which may give increased expansion prospective when compared to more created markets.

Hedging Possibilities: Abroad futures can be employed to hedge versus forex risk, geopolitical gatherings, along with other worldwide components that might affect your investments.

Leveraged Trading: Futures investing permits you to Handle a large place with a relatively compact degree of capital, due to leverage. This could certainly amplify your likely returns, however In addition it improves possibility.

Risks of Investing Abroad Futures

Forex Chance: Fluctuations in exchange premiums can impression the worth of your respective overseas futures contracts, bringing about opportunity losses.

Regulatory Differences: Distinct countries have different rules, which could have an affect on how futures contracts are traded and settled. It’s essential to familiarize on your own with The foundations of the Trade you’re investing on.

Time Zone Challenges: Buying and selling in different time zones is often challenging, particularly if it necessitates you to monitor markets in the course of non-standard hours.

Sector Volatility: Intercontinental markets is often hugely risky, and gatherings like political instability or economic downturns may lead to sharp price actions.

Getting going with Abroad Futures Investing

To start buying and selling overseas futures, start off by researching international markets and determining the exchanges and contracts that align along with your financial commitment targets. Open up a trading account by using a broker that provides usage of these markets, and make sure to familiarize you with the precise policies and prerequisites from the exchanges you’ll be trading on. Get started small and gradually improve your publicity as you achieve encounter and self-confidence in the trading technique.

Conclusion

Overseas futures buying and selling provides a novel chance for traders to develop their horizons and tap into world-wide marketplaces. Though it comes along with its possess set of worries, the potential benefits might be considerable for individuals who make the effort to understand the marketplaces, control challenges properly, and keep knowledgeable about Global developments. By approaching abroad futures trading using a very well-thought-out approach, you are able to unlock new avenues for expansion and diversification in your financial commitment portfolio.

By educating by yourself on the intricacies of overseas futures trading, you can also make educated decisions and confidently navigate the complexities of the global monetary marketplaces.

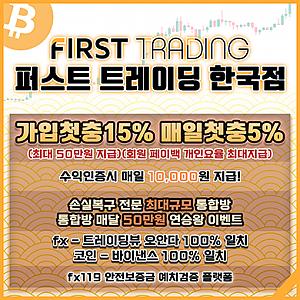

Get more info. here: fx시티